Attention risk leaders!

Whilst some companies were blessed in 2020 with a growth accelerant, many companies – perhaps the majority – were focused on repositioning, recalibration, risk-reassessment and survival. The most successful companies, be it companies whose success can be measured on their ability to survive, or for those companies with positive balance sheets, have learned important lessons about risk and business continuity. It will be short-sighted and misplaced to not embed these lessons into our outlook for 2021. The year ahead will be filled with a myriad of risks, opportunities, costs, and black swan events (yes, even more!)

Many new efficiencies have rushed forward, not least Covid vaccines, telecommuting to work, and a rise in tech-literacy. All companies are wrestling with decisions about their global workforce distribution, office-based real estate needs, client expectations, employee requirements and obligations, international supply chains and partnerships, and the impact of risk and compliance on all of these issues.

Those companies that did not already understand the value of business continuity processes, scenario planning, good governance and compliance, and integrating risk amongst all business activities and decisions, do now. As has been said by several of The International Risk Podcasts guests, the time to establish crisis management systems and structures is before the crisis, or as Dr Hani Taleb said in a podcast discussion with Dominic Bowen in late 2020, “the time to fix your roof is when it is dry, not when it is raining.” But for all the planning within our organisations, these plans are implemented by people, and as discussed in this week’s podcast with Romi Gaspirc, people bring differing risk appetites, experiences and competencies, and willingness to comply with company policies on a variety of topics that ultimately increases your risk exposure.

At the macro-level, we saw the further eroding of multilateral cooperation and an increasing trend of nationalism, friction, and division. Whilst Covid had some success stories, including the European Union’s attempt to buy and distribute Covid vaccines as a united block, there was still some unilateral self-interest at the fore including from both large (Germany and France) and smaller (Hungry and Poland) EU member states. 2021 is likely to experience similar amounts of mistrust amongst the political leadership class, and this will manifest itself in ways that impact all of our companies in the form of growing cyber threats, political contests, protectionism, and crime.

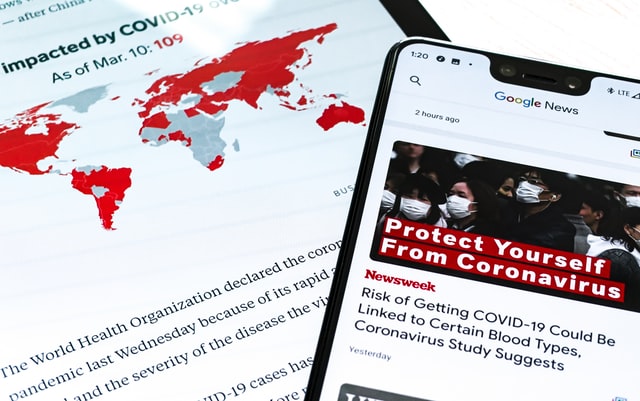

Covid in 2021

The recovery that everyone reasonably expects in early to mid-2021 will bring much needed relief to many, but not all. The economic recovery will be uneven between nations and between industries. Competition will be fierce in 2021, not least between countries keen to recover economically from their extensive social welfare programs in 2020. Sovereign risk concerns may cause some governments to prolong earlier austerity plans, end bailouts abruptly, or be forced into unhealthy debt actions. Understanding the relationships and risks between governments and companies around the world will be critical for business continuity. Companies will need to be alert to Covid flare ups, as well as potential government responses around the world. All companies have some level of international exposure and far-away government decisions about trade regulations, travel restrictions, and domestic support can have a substantial – positive or negative – impact on your partnerships, supply chains, and customers. Government policies and rhetoric will matter and very different scenarios could come to fruition depending on subtle differences amongst some key governments. Review the possible scenarios, along with triggers for potential crisis will be crucial to ensure your company is on the right side of any new developments.

The risk of missing the rebound

Companies best placed to take advantage of the coming economic rebound will have well-established market intelligence practices, risk monitoring systems, and high levels of global awareness and insight.

According to the latest data from Oxford Economics, countries with highest GDP growth in 2021 are going to include: Greece, Croatia, Czech Republic, Spain, Portugal, Belgium, Thailand, Philippines, and Indonesia. How well are your current monitoring and analysis practices to be ready to capitalize on opportunities emerging from these markets? At the same time, supply chains and e-commerce has advanced significantly across Africa, as have intra-regional trade agreements in the last few years and the opportunities in several African countries remain ripe.

Now, more than ever, it is important for risk, compliance, and security specialists to be digging deep into the horizon (who doesn’t enjoy a mixed metaphor) searching for opportunities and risk triggers including political, economic, and social instability, cyber threat trends, and evolving crime patterns.

Next step for risk leaders

We live in a world with more connectivity, high levels of automation, lower transaction costs, and massive shifts in society and social norms. Disruptive innovation will be at the fore of our lives, whether we realise it or not. The speed and mobility of information flows (both valuable and white noise) is by passing traditional information and organizational hierarchies and has generally positive implications when leaders adapt. Your employees, your clients, and competitors have greater insight than ever before and you need to be forward leaning in your positioning and communication about your threat perceptions, risk profile, and risk treatment plans. The barriers that previously existed for a variety of actors has diminished with the lowering cost of entry. This has made competition fiercer, criminal activity easier, and customers better informed. Your company’s internal bureaucracy is likely to be the biggest speed hump in capturing new clients. What does all this mean for risk leaders? It means you need to create a culture of ownership with responsibility, of learning and entrepreneurialism, value talent like never before, lessen bureaucracy, and have genuinely flatter hierarchies, dynamic and faster decision making. The behaviours of your companies executive leaders, of compliance, risk and security personnel will make a bigger impact than your policies. Observable behaviours that all employees own and demonstrate will be more valuable than the byline on your website. Defining and then living a real culture of risk appreciation and ownership, including rewards for taking measured and responsible risk should be your focus today.

Read more about 2021 risks here