The war and the rest of the world

The Russian war against Ukraine has led to one of the most unstable times in recent history – both politically and economically. The war is not a phenomenon that remained isolated to the eastern region of Europe. Its impact has reached all around the globe – causing serious issues such as worsening hunger in underdeveloped countries and impeding the access to basic heating and energy in the west of Europe. The nuclear threat due to the Russian occupation in Zaporizhzhiais another pressing issue that seems to be on the verge of escalation. And as the conflict seems to be nowhere near being resolved, the impacts and risks implied by this instability are only bound to grow.

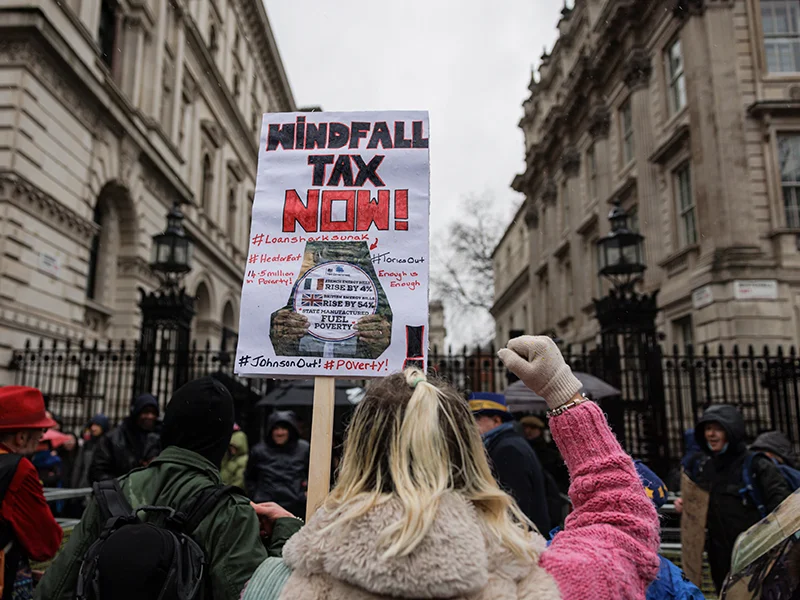

In Britain, the war led to the inflation of both basic necessities prices – such as food and hygiene items – and energy. And while the former might have been generally more manageable, the latter led to the rise of housing prices – which were already high – and the brunt of unmanageable bills. The Boris Johnson administration had planned caps for energy costs. However, as soon as Liz Truss took over as PM, lowering the cost of energy has remained under the limelight as an ongoing issue. In an attempt to ease the financial burden, Truss approved the removal of the fracking ban. Since then, the ban has been reinstated when Rishis Sunak became prime minister and the 25 percent increase of the windfall tax on oil and gas – opposed by Truss — has been passed. While, for now, measures aim to ease the cost of living crisis, the rapidly decreasing natural energy resources remains a pressing issue, involving long-term risks.

Energy crisis in Britain

Regarding the shortcomings of windfall taxes and the possible benefits of the controversial fracking, Charles McAllister, the director for, has raised a few important points in the International Risk Podcast episode discussing fracking in the UK. First, the extension of the windfall tax on oil and gas until 2028, shows the current government expects high energy prices at least for the following 5 years, hinting at the seriousness of the issues with energy supply. The current situation is owed to the erratic energy policies that have been passed in the last 10 years. Developing energy infrastructure requires time and considering the UK has had, on average, one energy minister per year, the policies implemented have not had the necessary continuity.

In this situation, the economy can only be bound to plummet – and it did – considering the UK has recently entered recession. As an alternative, fracking is a solution which could mitigate the risk of over-reliance on gas imports – a factor which contributed greatly in the current crisis – and create the necessary jobs to get the economy running again, while also earning the government tax revenue. British shale gas can contribute to the lack of energy supply faced in the context of increasing demand – which is only bound to aggravate as nordstream 1 and 2 are at risk of being shut down – but it can also generate the necessary funds for the government to subsidise isolation projects of homes. This is a long-term solution to decrease demand for energy and lower carbon emissions. This is a long-term solution to decrease demand for energy and lower carbon emissions, while also offering a cheaper alternative to imported LNG.

International Risks?

Right now, the UK is negotiating with the US for 10 million cubic metres of gas, which is, ironically, sourced through fracking. The subject of fracking has been controversial, in part, due to its environmental impact – whether that is the risk of seismic activity, contamination of water and soil from the chemicals used, or the emissions of CO2. It poses the question then, how accurate are these risks, considering the UK decided to use American shale gas. The highest recorded seismic shock was 2.9 Richter, in Lancashire, in 2019 and led eventually to the fracking ban, as it surpassed the established 0.5 limit. As a term of comparison, however, fracking has a very low tolerance for seismic activity – in construction works and coal mining, quakes up to 2.9 Richter are tolerated, without any facts which can explain this difference.

Fracking begins to look like a political choice, rather than an environmental one, knowing that higher seismic rates are tolerated in other industries. And due the multitude of regulations imposed on the methods used in fracking, there aren’t truly many proven risks when it comes to the chemical aspect either. While there have been instances of water contamination due to the methane in fracking, those were the result of poor methods. In the UK fracking is only allowed at a depth of 2 metres. Groundwater can be found at 200 to 300 metres deep, making it unlikely for the chemicals used in shale gas extraction to reach it. Even so, the substances used are closely monitored, must follow parameters imposed by the government and pass meticulous tests in order to be used. All chemicals involved in the fracking process are created in order to respect pollution norms and should not be poisonous or harmful.

The current economical situation is demanding action, especially in the face of continuously growing risks of blackouts, famine and the increasing number of people who could be at risk of dying from the cold this winter. Fracking, although an unpopular solution, could be an alternative which would provide jobs, energy and long-term decarbonisation infrastructure.

Pingback: Episode 94: Catherine McBride on Energy Security and Risk – The International Risk Podcast