Skyrocketing Gold prices: 2025 geopolitical risks and trends

In this episode of The International Risk Podcast, Dominic Bowen is joined by Dr. Moshe Lander to examine the waves of gold prices and investment trends, and what they are linked to, from investor sentiment to geopolitical instability and historic legacy. Moshe Lander is a Canadian economist and Senior Lecturer at Concordia University, and a sessional instructor at Dalhousie University. A former Senior Economist with the Government of Alberta, he specializes in public economics, international trade, and the economics of sports, gaming, and gambling. A very engaging communicator, he is a frequent media commentator on economic and policy issues across Canada.

Gold’s glittering comeback: timeless haven or market hype?

Just a few weeks ago, the financial world watched as gold didn’t just break records -it shattered them. Prices soared to an all-time high of over US$4000 an ounce on October 7th, and reached about $4,380 on October 20th, a new peak that challenges even the inflation-adjusted records of the 1980s. This surge isn’t just retail speculation. Central banks have also been on a buying spree, adding a staggering 1,037 tons to their reserves last year alone, marking one of the largest purchases in history.

What is this spike linked to? Is gold simply trending, or is it reasserting its age-old role as the ultimate safe asset in a world on edge?

More than money: Gold’s enduring social and psychological power

One of the reasons for this rush towards gold is its unique position as a physical, historic chief symbol and asset. As our guest, economist Dr. Moshe Lander, explains, the precious metal has diverse modern applications in healthcare for dentistry, technology for its conductivity in electronics, and aerospace for shielding spacecraft (source: National Mining Association, Mining Powers the Holidays and Secures Our Future, 09/12/2024), giving it a well-recognized value far beyond simple investment.

Gold is tangible, but different from money. As Dr. Lander says, the value attached to money is dictated by our governments, whereas gold has a social, trading, and psychological value in our societies. History plays a huge part in this: for over 5,000 years, from the tombs of pharaohs to the coffers of empires, gold has been the ultimate symbol of wealth, with the Lydian kingdom being the first to mint standardized gold coins around 550 BC, cementing its role in global trade for centuries.

Navigating the storms: uncertainty in a fracturing world

Dr. Moshe Lander says ongoing currency wars and Donald Trump’s current threats regarding taxes have given investors a reason to step away from the dollar. But the geopolitical fragmentation certainly started long before Trump’s presidential terms -the “dot.com crash,” 9/11, the 2008 subprime crisis, and Covid have all chipped away at market confidence. Taking the example of the Canadian dollar, he says the currency observed a return on investment of about 1,000% over the last 20 years; Gold prices in Canadian dollar terms are worth 9 times more than that over the same timeframe.

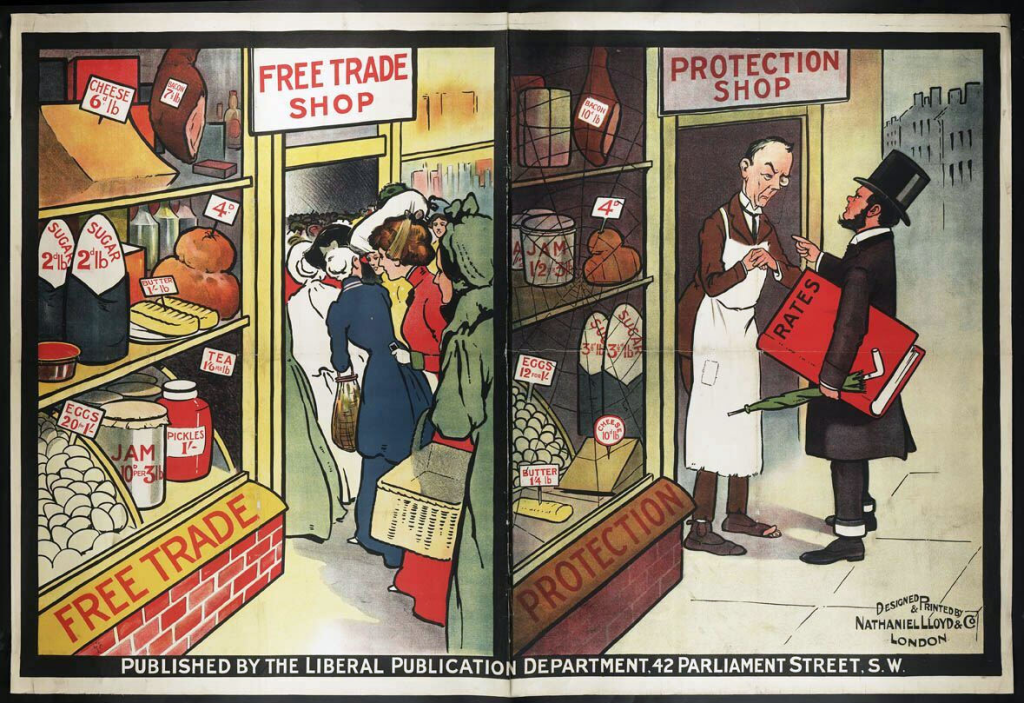

Moreover, the world is moving towards less free trade. We have witnessed the U.S. and Canada’s legacy of the ‘Auto-Pact’ dating back to 1965 be threatened, and the Canada-U.S.-Mexico free trade agreement is “up for review” in 2026, which worries Moshe.

Today, as the President of the United States -leader of what is still the world’s largest economy by nominal GDP (Source: International Monetary Fund, World Bank) threatens to punish the world by raising tariffs, the dollar no longer seems like the safest asset. And there enters gold.

This sentiment is echoed by the International Monetary Fund, which stated in a recent report that “global markets are facing an increased risk of a disorderly correction” (Source: IMF Global Financial Stability Report, October 2025). The situation is marked by what the report calls stretched valuations and high concentration in major stocks, notably the AI-related megacaps -giant tech companies like Nvidia and Microsoft whose massive growth now represents a disproportionately large share of the market, making the entire system vulnerable to a tech-sector downturn. Moreover, going back to when Trump’s April 2020 calls for “liberation” from lockdowns added political fuel to the fire, the market had just suffered a 20 to 30% drop due to the pandemic, highlighting the economy’s fragility.

Moshe believes Trump’s foreign affairs and finance approach will have a “long-lasting legacy”: “Once you decide that you can use trades and tariffs as a weapon, who’s to say that a democrat president in 2028 won’t use that as well?”

Furthermore, an augmentation of the share of gold held by emerging markets is related to the process of “de-Americanisation” of the world, according to Dr. Lander. Emerging market central banks have consistently been the world’s largest gold buyers for over a decade, seeking to diversify their reserves away from the U.S. dollar. Finally, he points out the diversity in gold extraction. Today, Canada is the 4th largest gold extractor in the world, behind China (first global extractor), Russia and Australia (source: World Gold Council, Global mine production, 06/12/2025).

The old guard VS the new code: Gold versus Digital Currencies

Crypto’s current market value recently reached $2.5 trillion US. This value, Dominic reminds us, represents roughly 1/10th of the amount of gold that has been extracted worldwide. Central Banks are also moving towards digital currencies; in fact, over 90% of the world’s central banks are actively exploring Central Bank Digital Currencies (CBDCs), with countries like China already running advanced pilot programs for a “Digital Yuan”.

But our guest remains sceptical about the stability and real value of cryptocurrencies. As he smartly puts it, you “can’t buy from your local coffee shop with crypto.” He also draws a limited image of money: taking the example of Canadian dollars again, he says that cash can only be used in Canada. Therefore, compared to Gold, certain currencies -and even more so crypto- do not have a store of value because they are volatile. Admitting that gold experiences some crashes, it still “delivers a much better value over time.” For our guest, crypto and gold’s values are “not a valid comparison yet.”

What about the future then? Moshe uses the launch of the internet back when the World Wide Web first became publicly available in 1991 as a comparison with how crypto is perceived today. It might evolve in unexpected ways, but nothing’s predictable right now.

How to approach investing in Gold?

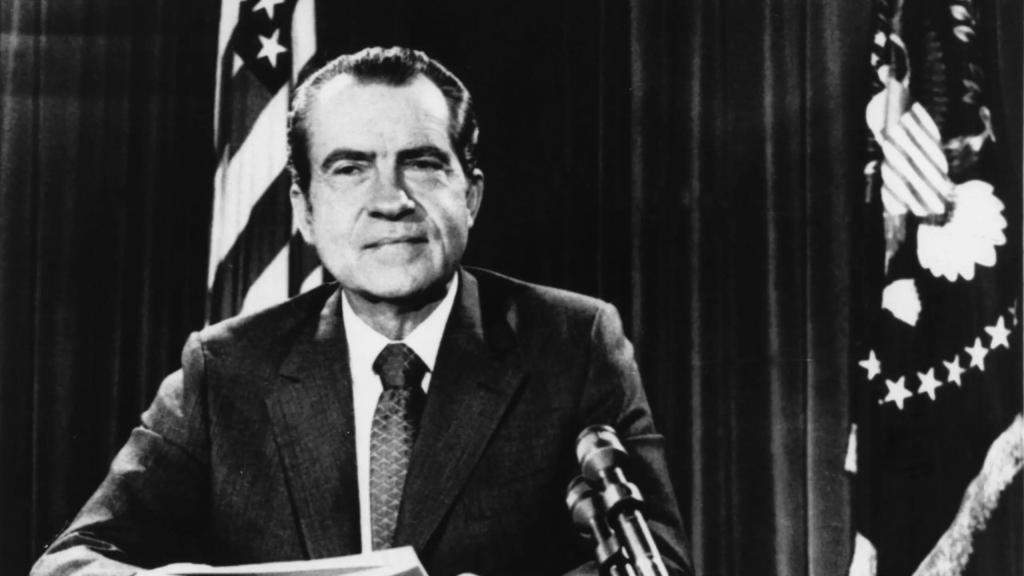

Since President Richard Nixon’s removal of the “gold standard” on August 15, 1971, a move that formally ended the U.S. dollar’s direct convertibility to gold and allowed its value to float freely, investors have called Gold the ultimate “safe haven.”

How does it compare, during uncertain times, to other assets? Dr. Lander says Gold can easily move 10 to 15% in its value in a short turnaround time. However, warns the expert, to make it your main asset, you would have to be able to “time the market well.” Requiring loads of storage to be profitable, a new necessity arises with gold investment: high security. Therefore, to make a profit large enough to “make you rich,” Moshe says investing in a mining company would be the most logical choice.

Furthermore, Moshe points out that the hardest bit about investing in Gold is the “exit strategy.” The same 2025 IMF Global Financial Stability Report that warned of market corrections also noted that these exits might be uncontrolled or unstructured, creating chaos for investors trying to sell. Therefore, before any investment, Dr. Lander advises thinking of the “time horizon,” as gold often takes a long time to become profitable because it is “adjusting with inflation.” For many, long-term, small investments might be best.

Conclusion: Trust, Trade, and a “demographic time bomb”

Looking ahead, Dr. Lander is concerned about the cyclicity of our demand-driven world. He quotes former U.S. Federal Reserve Chair Alan Greenspan’s famous warning of “irrational exuberance,” pointing to overvalued businesses and unsustainable consumer and government behavior, especially over the last five years -Covid restrictions and consumer fears have disrupted centuries-old supply chain methods, creating a new focus on “onshoring” as many supplies as possible.

Moshe juxtaposes the potential next crisis with the 1970s Oil shock, warning that the generation of experts who navigated that crisis is retiring, leaving our economies with a potential experience vacuum in key positions of power.

An ardent free-trade supporter, Dr. Lander suggests our governments move towards more free trade to “allow for a little bit of insulation to absorb more shock.” He suggests they take example from the way Scandinavian countries managed their economic crises in the 1980s and 1990s, while adapting those case studies to much larger populations. “Governments better figure out how they’re going to balance a demographic time bomb that’s waiting for them, and all of the promises that they made,” he cautions.

The episode concludes on the need for more transparency from our governments as our societies deal with climate change, higher demographics, and the battle for global leadership. As long as uncertainty clouds the horizon, Dr. Lander believes in gold’s lasting investment value, as fear builds in people wanting to take refuge in something durable.

2 Comments

Comments are closed.