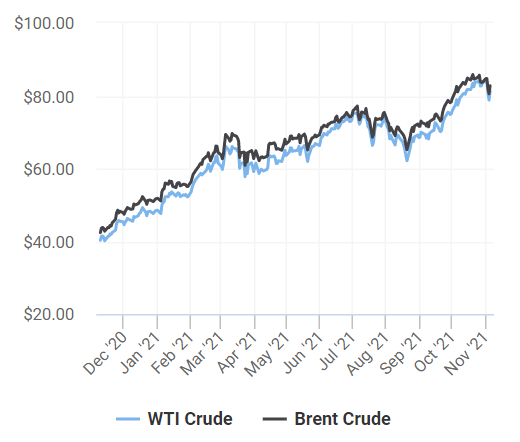

Despite the discussion at COP26 in Glasgow, there is and will remain continued high demand for oil for the foreseeable future, increasing the likelihood of continued upwards pressure on oil prices globally. OPEC+ agreed to maintain current oil production output with gradual increases in oil production. This lead to WTI Crude prices increasing 3.12 percent in early November, up to US $81.27 a barrel. Demand internationally for oil has continued to increase, consistently outpacing OPEC oil outputs. As many countries race to transition from Covid restrictions into a period of rapid economic growth, demand for oil is likely to increase, further increasing international risks associated with higher oil prices. Combined with continued unrest in Iraq, Iran, Venezuela and Nigeria, the international risk landscape amongst many oil producing countries does nothing to calm concern about oil supply distributions. Whilst Saudi Arabia is increasing oil output, there are supply concerns in many markets including the USA, Europe, and the UK. Oil output will rise to 400,000 barrels per day from December, but this will not reduce the international risks associated with increasing oil prices.

The international risk profile of OPEC, as influenced by OPEC members’ domestic politic risk, on oil prices is clear. As domestic political risks increase amongst OPEN members, so do does the upwards pressure on oil prices. The timeframe of cause and effect from domestic political risk uncertainty and notable changes in oil prices appear within a year and usually last for as long. A join Cambridge and Beijing Institute of Technology study found that domestic political risks can contribute to over 17 percent of oil price fluctuations. And within domestic political risks for OPEC member countries, internal conflict continues to be the main risk driver and contributor to oil price fluctuations.

The international risks of increased oil prices

The risks internationally of continued and sustained increased in oil prices are multifaceted. The correlation between oil prices and petrol prices at the pump is directly related and the positive correlation between the two means that at the household level we can expect the share of household income spent on rising oil prices to continue, meaning less spending on other services and products. Higher oil prices globally will also directly impact consumers with higher prices for flights. The airline industry’s profitability is heavily tied to oil prices and upwards pressure on oil prices will quickly be passed on to travellers keen to become mobile again after Covid restrictions. The retail sector which in many markets globally is seeing a fantastic rebound in the last quarter could be negatively impacted if consumer confidence reduces and spending is reduced.

When we consider the macroeconomic impact of recent OPEC decisions and the international risks associated with high oil prices, we see the causal link to increasing inflation and reduced economic growth. Oil prices directly affect the cost of production for items using petroleum, and undoubtedly have an immediate impact on the costs of all other goods by association with increasing costs of transportation, heating, and manufacturing. Depending on the supply chain and manufacturing processes, will depend on the risk exposure to oil price fluctuation and the costs for business, and ultimately consumers.

Increases in oil prices affects the available resources that consumers and business can spend on other activities, and the risks to economic growth increase as international oil prices rise. There is some, although not consistent, correlation of the risks internationally of economic downturn and recession and increases in oil prices. Approximately 70 percent of the recessions to occur in the US in the last two decades were preceded by significant upwards pressure on oil prices globally. But inflation and increasing oil prices does not have to be paired, and the correlation with economic growth, inflation and unemployment in the post-Covid period will all be influenced by a range of international risk factors in addition to oil price.

NB. OPEC+ is the Organisation of the Petroleum Exporting Countries (13 countries), plus ten of the world’s most significant non-OPEC oil exporting countries. OPEC+ objective is to regulate supply of oil on the international market in order to control global oil prices and manage international risk.

Pingback: Rising Energy Prices – The International Risk Podcast