From AI to Bullion: What Gold Tells Us About Market Risks in 2025

For the past decade, gold appeared as a relic of an outdated financial era. In a world of technology stocks, cryptocurrencies, and AI growth narratives, a metal that produces no yield and stays in vaults seemed less relevant. Nevertheless, in 2025, gold has returned to the centre of the stage, trading above $4,000 an ounce and forcing investors, policymakers, and CFOs alike to revisit their views on money, power, and risk.

In this episode of The International Risk Podcast, Dominic speaks with Russ Mould, Investment Director at AJ Bell, about why gold has reasserted itself and what its resurgence reveals about the weaknesses of the global financial system. Their conversation offers a careful vision of the situation: Russ reminds us that markets may evolve, but the underlying drivers of risk, aka confidence, valuation, and political power, remain stubborn.

Gold’s Unexpected Comeback

Inflation, in many advanced economies, has moderated from its post-pandemic peaks: interest rates remain elevated, and equity markets (a place where companies issue shares and investors trade them), particularly in the United States, have kept delivering high overall returns. Although it is to be mentioned that the topline figures you see in the news (e.g., major indices like the S&P 500, CAC 40, FTSE 100) do not necessarily reflect what all stocks or investors experienced, historically, such conditions drive investors away from gold.

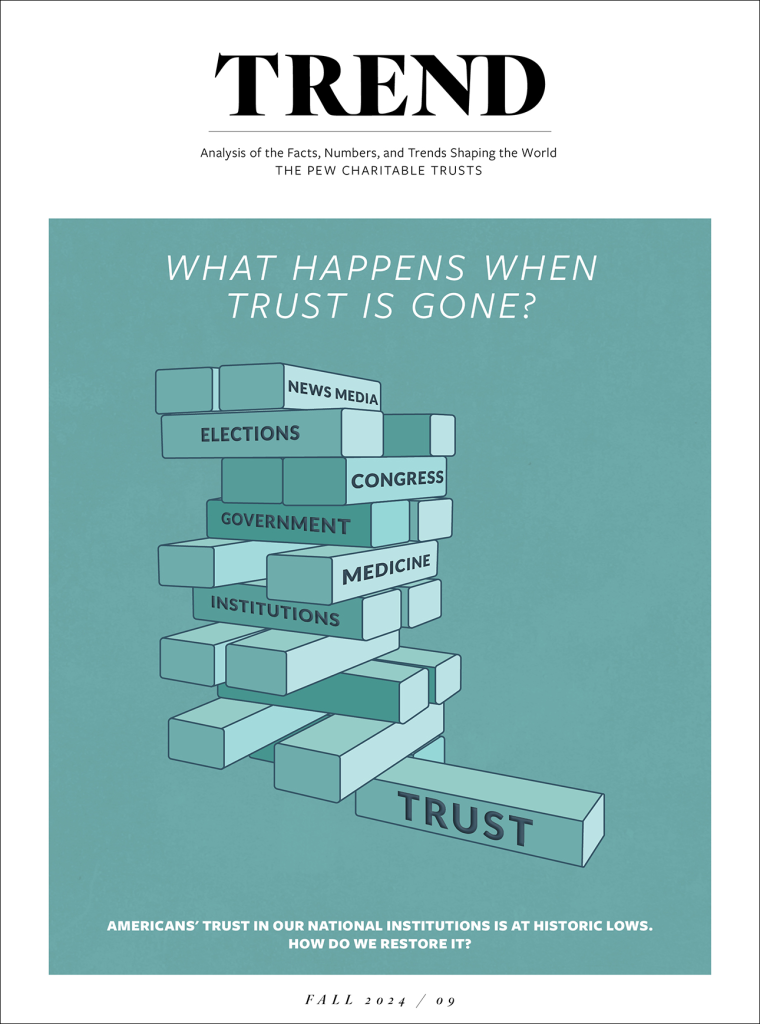

Yet, as Russ Mould notes, gold is not simply an inflation hedge or a tactical trade. It is, at its core, an indicator of trust. Over thousands of years, gold has functioned as money, not because it is efficient or productive, but because it is durable and politically neutral. When confidence in institutions, currencies, or rules begins to wear out, gold tends to reassert its relevance.

1925 See Charlie Chaplin in “Gold Rush” Silent Movie Token Hartford, Connecticut

What distinguishes the current surge from previous episodes is its multiple drivers. Inflation certainly encourages gold investments from individuals and central banks alike seeking alternatives to traditional stores of value, but the main drivers are geopolitics, sanctions, continued debt, and market concentration –which may lead to monopolistic practices.

Sanctions, Power and the Weaponisation of Money

What makes gold’s resurgence thrive most is the weaponisation of the global financial system. The freezing of Russian foreign exchange reserves following the invasion of Ukraine sent a clear signal to governments worldwide: reserve assets are not mere economic instruments, but political ones.

For decades, US Treasuries and dollar-denominated assets (asset which price and return are in dollars) were considered the ultimate safe haven -cash and backed by the world’s largest economy. That assumption has not collapsed, but it is definitely being challenged. Countries with complex relationships with the West have begun to ask questions: What are the consequences of the freeze of Russian assets on other economies? If reserves can be frozen once, can ours be frozen too?

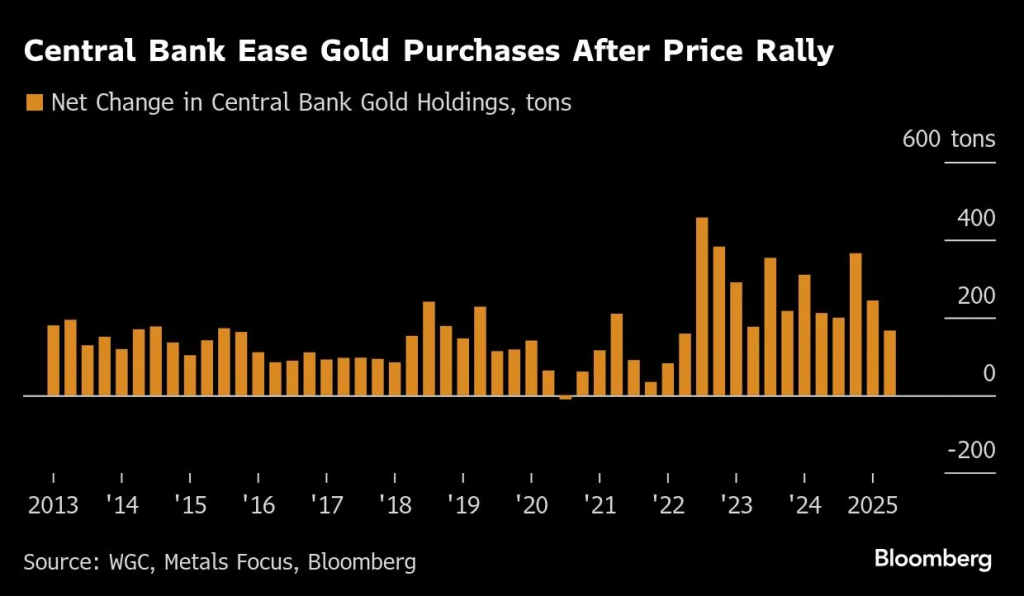

The response has been visible in central bank balance sheets. China, India, Turkey, and several other emerging economies have increased their gold holdings, slowly reducing exposure to the dollar. Gold, unlike sovereign debt, carries no counterparty risk. It cannot be sanctioned (“frozen”), defaulted on, or digitally blocked.

WebProNews, De-Dollarization Accelerates in 2026: BRICS Shift to Gold and Local Currencies, January 20, 2026, Ava Callegari

While this shift does not signal the impending demise of the dollar, it does point to the fragmentation of the monetary order, in which gold plays the strategic role of anchor outside big markets.

Debt, Confidence, and Financial Repression

Alongside geopolitics, the scale of global debt has become increasingly difficult to ignore. Government borrowing surged during the pandemic and has not reversed. In many economies, debt-to-GDP ratios sit at levels historically associated with financial repression: a policy mix of controlled interest rates, inflation, and regulation designed to diminish the real value of liabilities over time.

For investors and corporate treasurers, this raises “uncomfortable questions”, says Russ, about the long-term purchasing power of fiat currencies (a government issue whose value is based solely on institutional trust and legal recognition, like money). Cash now carries its own form of erosion risk; bonds (loans made to governments) offer limited protection if inflation remains structurally higher than in the pre-2020 era.

Pew.org, Trend Magazine, Americans’ Deepening Mistrust of Institutions, Claudia Deane

Gold does not solve these problems, but it exists outside them. It does not depend on the credibility of fiscal policy or the discipline of central banks. As Mould observes, gold’s appeal lies less in its performance during boom times and more in its resilience when confidence in policy frameworks weakens.

Is Gold Really a Safe Haven?

Despite its renewed popularity, gold is often misunderstood. It is not a guaranteed hedge against market volatility, nor does it always rise during crises. During shocks -like the 2008 financial crisis or the early days of COVID- gold prices initially fell as investors sold anything liquid to raise cash.

Therefore, Gold’s value resides not in short-term crisis insurance but in long-term capital preservation. Over decades, it has tended to hold its real purchasing power, even as currencies have been devalued, regimes have changed, and markets crashed.

That distinction is particularly relevant today. Investors chasing gold purely for momentum risk disappointment if prices correct, as they inevitably do. But for those concerned with systemic risk, gold functions as a form of insurance against extreme but plausible outcomes such as prolonged inflation or geopolitical escalation.

Metal and Miners, WORLD GOLD COUNCIL: Central bank gold buying slows after record rally cools demand!, August 6, 2025.

Equities, AI and Concentration Risk

The Motley Fool, 3 AI Stocks to Buy in 2026 and Hold Forever, February 1, 2026, Keithen Drury

Gold’s rise has also coincided with growing unease about equity market concentration (meaning that a large part of the market capitalization is concentrated in a small number of stocks), particularly in the United States, due to a takeover of index returns share by a small group of mega-cap technology firms -mostly linked to artificial intelligence. While these companies are highly profitable and strategically important, their dominance may introduce fragility. Russ Mould draws parallels with past technology cycles: during the dot-com boom, genuine innovation was accompanied by excessive valuations and unrealistic growth assumptions. When expectations eventually corrected, even strong companies saw dramatic declines in share prices.

Today’s AI leaders are not shielded from valuation risk. Markets that appear diversified on the surface may, in reality, be too highly exposed to a narrow set. In such an environment, assets that behave differently, like gold, regain relevance as “portfolio stabilisers”.

The Curious Case of Gold Miners

Historically, gold mining stocks amplified miners’ gains from rising gold prices (because revenues grew faster than costs). However, even with gold at record highs, many miners have underperformed the metal, indicating that this dynamic has weakened.

Part of the explanation lies in rising production costs and investor scepticism shaped by years of capital misallocation within the sector. Yet, as Mould points out, margins have improved and balance sheets are stronger than in previous cycles. Valuations (meaning, how expensive or cheap assets are), in many cases, remain reasonable.

ProactiveInvestors, Gold’s glow brightens, but London miners fail to shine, October 8th, 2025, Ian Lyall

For disciplined investors, this opportunity remains risky. Mining equities remain equities, suggesting exposure to management decisions, jurisdictional risk, economic trends (a sustained period of disinflation without recession could restore the appeal of bonds and cash), and broader market sentiment. They are not substitutes for physical gold but complements with a different risk profile.

Old Assets in a New World

Perhaps the most striking takeaway from the conversation with Russ Mould is how modern the gold debate has become. This is not a rejection of innovation or growth, but an acknowledgment that financial systems are built on trust as much as technology. AI, private credit and digital assets may shape the future, but they do not eliminate the risks inherent to debt and power through human decision-making.

Gold’s resurgence is less about nostalgia and more about now: our fragmented world is marked by geopolitical rivalry and concentrated markets, and investors are simply rediscovering the value of assets that sit outside complex financial chains.

As markets continue to evolve, the lesson is not that gold is superior to other assets, but that diversification -across asset classes, geographies, political systems…- matters more than ever. In that sense, gold is not a bet against all odds, but a reminder that even the most advanced systems benefit from simple, time-tested forms of insurance.